Apple is enforcing its privacy measures on iOS within months (if not weeks), thus limiting fingerprinting and encouraging app marketers to turn to SKAdNetwork (SKAN) for measuring and optimizing mobile ad campaigns.

2024 is being called “the year of SKAN” for mobile app marketers. It’s interesting to look into the adoption stats of SKAN as a measurement/optimization tool, and the different versions of SKAN – which obviously provide different functionality.

Dataseat, Kochava, and Wavemaker ran a joint webinar in January themed Driving Repeatable Success on SKAN and I’m happy to reflect upon what was shared and discussed. Couldn’t make the webinar? You can watch it here on demand:

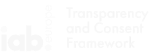

SKAN 4 is lightyears beyond SKAN 3

From an optimization standpoint, what we see at Dataseat is that SKAN 4 is lightyears beyond SKAN 3. SKAN 3 was the first version of SKAN that was indeed “fit for purpose” — but SKAN 4 is a tremendous leap forward.

It gives us the ability of better optimization and better LTV tracking, and even the ability to better optimize across more inventory.

In SKAN 4 we were introduced to the coarse-grained conversion events which are differentiated as low, medium, and high (while there is also fine-grained conversion value). Campaign ID was renamed into Source Identifier, and we got more values to inform campaign optimization.

Image source: Kochava

More on the history of SKAN and details on SKAN 4 vs. SKAN 3 here: The evolution of SKAdNetwork.

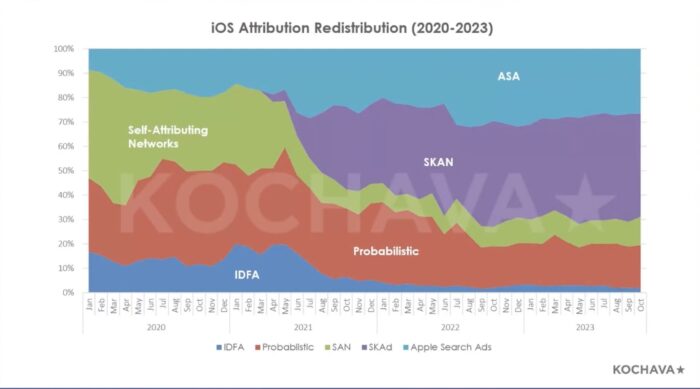

Probabilistic, IDFA attribution on decline, SKAN gaining traction

Image source: Kochava and Wavemaker

As seen in this graphic provided by Kochava, the old attribution frameworks and tools were declining in 2021, but then stabilized in mid-2022. It looks like advertisers found a certain balance in the combination of different attribution methods and are happy with their equilibrium.

Advertisers slow to transition to SKAN 4, missing out on its benefits

A lot of advertisers are reluctant to transition to SKAN 4, which can be partially explained by the fact that many advertisers are, so far, content with their current setup which is working for them to a certain extent.

On the other hand, new SKAN version adoption is a sort of a chicken-and-egg problem: advertisers are waiting for SKAN 4-enabled supply to lead first, and publishers are waiting for demand.

Becoming SKAN 4-ready is an effort for advertisers: they need to change their conversion models and ways they work with data received from Apple, configure conversion events, sort coarse- and fine-grained events and source identifiers. This lift certainly slows down the transition from SKAN 3 to SKAN 4.

Good news for advertisers that choose to adopt SKAN 4: they’re relatively early to capture that SKAN traffic.

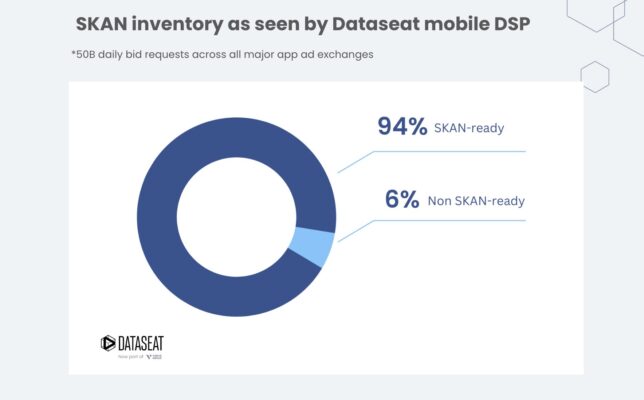

94% of in-app inventory is SKAN-ready

Image source: Dataseat

What we’re seeing on Datasesat’s ~50 billion ad requests is that 94% of inventory to date is SKAN-ready, which means the chicken-and-egg problem does not necessarily exist. There is a lot of inventory to bid on, while staying within Apple’s privacy regulations, and being able to optimize campaigns using SKAN data.

In 2023, for many advertisers this would have been exciting news or just a curious fact. In 2024, this is rather essential: as soon as Apple shuts the lid on fingerprinting by enforcing Privacy Manifests in Spring 2024, advertisers will have access to SKAN-enabled inventory at scale.

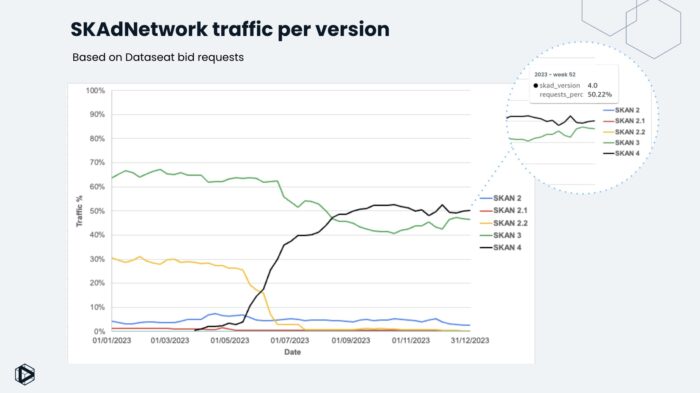

Uptick in SKAN 4 adoption while SKAN 3 still competing

Despite SKAN 4’s obvious benefits to advertisers, we still saw SKAN 3 dominate until late 2023.

Image source: Dataseat

Entering the summer months of 2023 we see a great jump in SKAN 4. Apple announced Privacy Manifests during WWDC in June, with the potential of being enforced in Spring 2024. This announcement probably caused the jump in the inventory that we’re bidding on.

The above graph shows traffic per SKAN version until the end of 2023, which saw roughly 51% of SKAN 4 traffic and roughly 44% of SKAN 3 traffic.

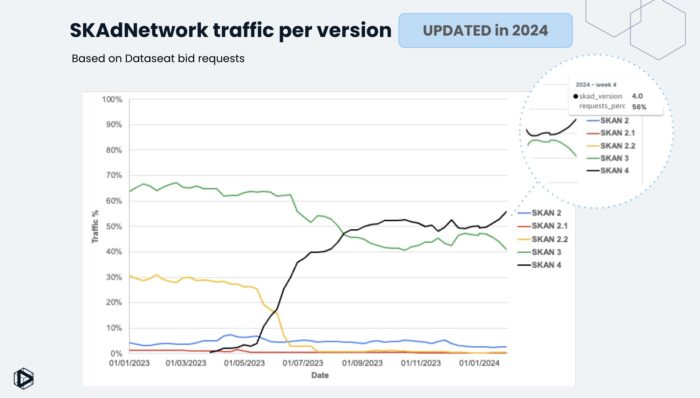

The data from 2024 is showing an upward trend in SKAN 4.0: version 4 was at 56% in week 4 of 2024:

Image source: Dataseat

That said, we’re also anticipating SKAN 5 and hoping for less inertia in adoption of the next SKAdNetwork version.

Dataseat is using SKAN 4’s possibilities to the fullest extent, and we are optimizing for all three SKAN 4 postbacks. We are not putting any pressure on the advertiser as to which SKAN version they use, but the majority of our advertisers that are on SKAN are currently using version 4.

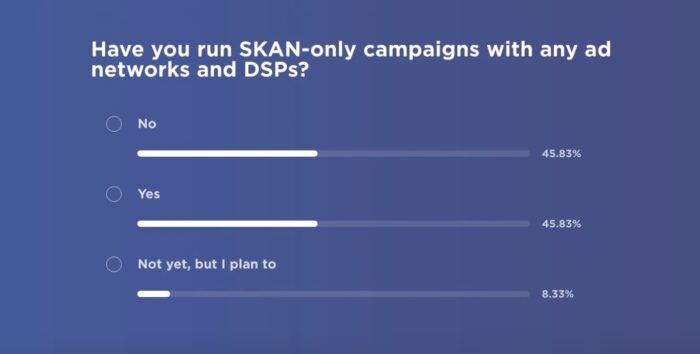

45% of advertisers have already run SKAN-only campaigns

This is an encouraging trend. Not every advertiser has budgets that allow the scale to unlock privacy thresholds, yet many advertisers are experimenting and thus gaining experience with SKAN. This signals that the industry is maturing into using privacy-enabled, more ethical advertising tech.

Image source: Kochava

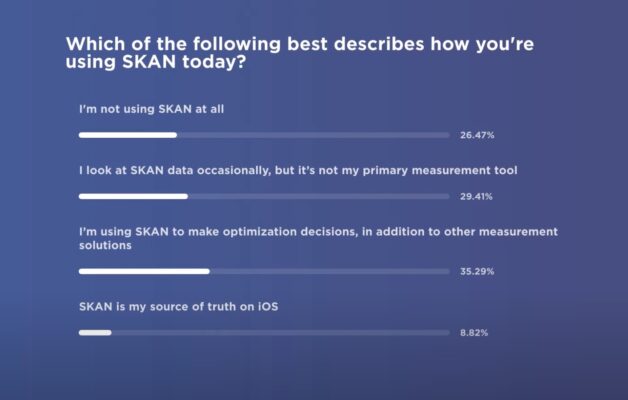

For 8.8% of advertisers, SKAN is the single source of truth on iOS

Still, the majority of advertisers are either using SKAN in conjunction with other measurement solutions (35%) or using SKAN occasionally while primarily relying on other tools (29.4%).

Image source: Kochava

These were only a few thoughts and insights exchanged during our conversation with Wavemaker and Kochava.

To talk about advertising on mobile without IDFA, as well as SKAN and how Dataseat excels at ID-less campaign optimization, get in touch: Contact Dataseat